Proactive Security: Bagley Risk Management Methods

Proactive Security: Bagley Risk Management Methods

Blog Article

Secret Aspects to Take Into Consideration When Finding Livestock Risk Protection (LRP) Insurance

When examining choices for Livestock Risk Protection (LRP) insurance, a number of essential factors call for careful factor to consider to make certain efficient risk administration in the agricultural field. Selecting the best coverage alternatives customized to your particular animals operation is vital, as is understanding exactly how premium expenses correlate with the degree of security provided.

Insurance Coverage Options

When taking into consideration Animals Danger Protection (LRP) insurance coverage, it is crucial to understand the different insurance coverage alternatives available to alleviate threats in the farming sector. Livestock Danger Defense (LRP) insurance offers different protection choices customized to fulfill the varied needs of livestock producers. Bagley Risk Management. One of the primary protection choices is cost protection, which secures versus a decrease in market rates. Manufacturers can pick the protection degree that straightens with their rate risk management objectives, permitting them to safeguard their procedures versus possible economic losses.

Another essential insurance coverage choice is the endorsement duration, which establishes the size of time the coverage holds. Manufacturers can choose the endorsement period that ideal fits their production cycle and market problems. Furthermore, protection levels and prices vary based on the sort of livestock being insured, offering producers the flexibility to tailor their insurance coverage prepares according to their particular demands.

Comprehending the various insurance coverage choices available under Animals Danger Protection (LRP) insurance policy is vital for producers to make enlightened decisions that properly safeguard their animals operations from market unpredictabilities.

Premium Costs

Livestock Danger Defense (LRP) insurance offers crucial coverage alternatives tailored to alleviate threats in the farming industry, with a significant facet to take into consideration being the estimation and framework of premium expenses. When identifying premium costs for LRP insurance policy, several elements enter play. These consist of the kind and number of livestock being insured, the protection level selected, the present market costs, historic cost data, and the length of the protection period. Insurance providers might likewise think about the place of the farm, as geographic factors can impact the total threat profile.

Insurers evaluate historic information on livestock costs and manufacturing expenses to figure out a proper costs that reflects the level of danger entailed. It is essential for livestock producers to meticulously evaluate premium costs and protection alternatives to guarantee they are properly secured against prospective economic losses due to damaging market problems or unforeseen events.

Eligible Livestock

The decision of eligible animals for Livestock Danger Security (LRP) insurance policy protection entails mindful factor to consider of details requirements and attributes. Livestock types that are typically qualified for LRP insurance policy include feeder livestock, fed cattle, lambs, and swine. These pets need to fulfill specific qualifications connected to weight arrays, age, and planned usage. Furthermore, the qualification of livestock may vary based on the specific insurance company and the terms of the policy.

Feeder livestock, for instance, are frequently qualified for LRP protection if they drop within specified weight arrays. Lambs are another classification of livestock that can be taken into consideration for LRP insurance coverage, with variables such as weight and age playing an important duty you can check here in determining their qualification.

Prior to selecting LRP insurance for animals, producers ought to meticulously evaluate the eligibility standards outlined by the insurance coverage copyright to guarantee their pets meet the required demands for insurance coverage.

Plan Flexibility

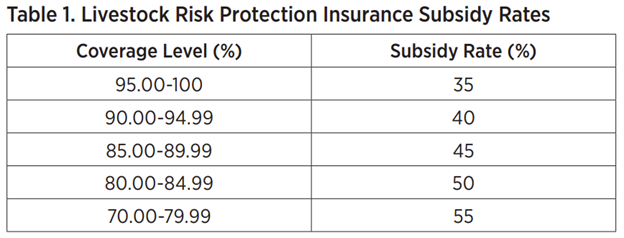

Policy versatility in Animals Risk Security (LRP) insurance policy allows producers to tailor protection to match their details needs and risk management techniques. This versatility equips animals manufacturers to tailor their insurance policy plans based upon factors such as the type of livestock they have, market conditions, and specific threat resistance degrees. One crucial facet of plan adaptability in LRP insurance is the capability to pick insurance coverage levels that align with the producer's financial goals and risk exposure. Manufacturers can pick insurance coverage degrees that secure them against possible losses because of changes in livestock prices, guaranteeing they are properly insured without paying too much for unneeded protection. Additionally, LRP insurance uses versatility in plan duration, enabling producers to select coverage durations that finest fit their production cycles and marketing timelines. By supplying personalized choices, LRP insurance coverage enables manufacturers to effectively manage their threat direct exposure while securing their livestock procedures against unforeseen market volatility.

Cases Process

Upon experiencing a loss or damage, manufacturers can launch the claims process for their Animals Threat Protection (LRP) insurance coverage by without delay contacting their insurance coverage provider. It is important for manufacturers to report the loss immediately to speed up the check that insurance claims procedure. When getting to out to the insurance service provider, manufacturers will certainly require to supply thorough details about the event, including the day, nature of the loss, and any kind of pertinent documentation such as veterinary records or market prices.

After the assessment is full, the insurance coverage service provider will certainly decide regarding the insurance claim and connect the outcome to the producer. If the case is authorized, the manufacturer will get settlement according to the terms of their Animals Threat Protection (LRP) insurance coverage. Bagley Risk Management. It is crucial for producers to be familiar with the cases procedure to guarantee a smooth experience in the occasion of a loss

Verdict

To conclude, when picking Animals Threat Defense (LRP) insurance policy, it is important to take into consideration insurance coverage alternatives, premium prices, qualified animals, policy versatility, and the claims process. These key factors will certainly aid make sure that breeders and farmers are effectively secured against potential risks and losses related to their animals operations. Making an informed choice based upon these considerations can ultimately lead to far better monetary safety and security and peace of mind for animals manufacturers.

Livestock Threat Security (LRP) insurance coverage offers various protection options customized to satisfy the diverse needs of animals producers.The determination of eligible livestock for Animals Threat Security (LRP) insurance coverage includes see this here mindful consideration of details requirements and characteristics.Plan versatility in Animals Threat Defense (LRP) insurance permits manufacturers to tailor protection to match their specific demands and risk monitoring approaches.Upon experiencing a loss or damage, manufacturers can start the insurance claims procedure for their Livestock Danger Defense (LRP) insurance by without delay calling their insurance policy supplier.In verdict, when picking Animals Threat Security (LRP) insurance, it is crucial to think about insurance coverage options, premium expenses, qualified livestock, policy adaptability, and the cases process.

Report this page